A Non-Fungible Token, usually referred to by its acronym NFT, uses technology that involves data on a blockchain that cannot be changed after they have been added. Therefore, while they share similar blockchain technology with cryptocurrencies, the functionality is different.

NFT’s functionality enables them to be used to prove ownership of an intangible-digital, or tangible-physical, asset, and the associated rights the owner has.

The most popular practical application of NFTs for digital assets is proving ownership of digital art, virtual items in computer games, and music.

The unique features of NFTs are becoming increasingly appealing as we spend more of our time online. Despite this increased popularity there is a lack of clarity over the final form this digital asset will take. The purchasing process in particular needs to be clarified.

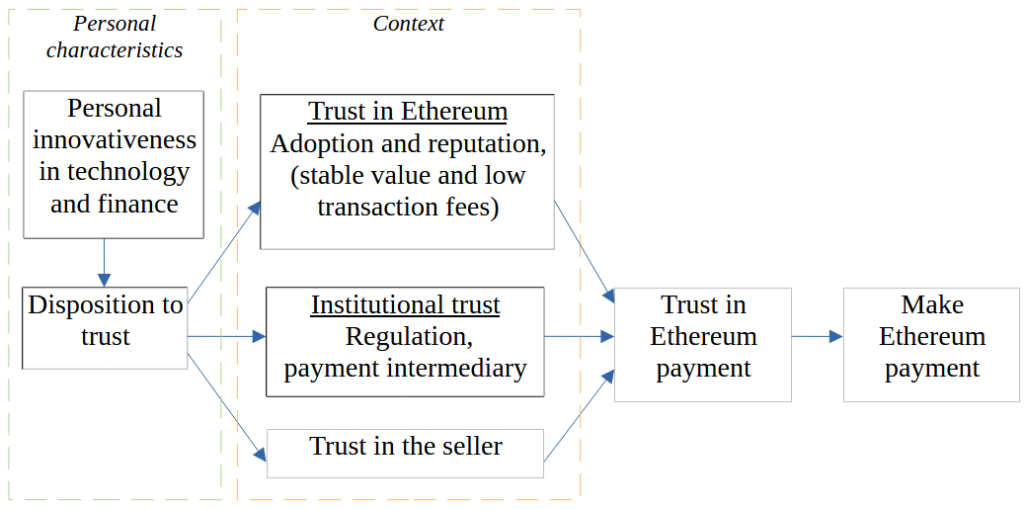

This research developed a model of the purchasing process of NFTs and the role of trust in this process. The model identified that the purchasing process of NFTs has four stages and each stage requires trust.

You see here in the figure, the four stages in the purchasing process on the left, and the trust required in each of these stages along the center. Finally, on the right you see that trust in all four stages leads to trust in an NFT purchase.

Figure 1. Model of consumer trust at each stage of the NFT purchasing process

The four stages of the purchase are: First, set up a cryptocurrency wallet to pay for the NFT, and to be able to receive it. Second purchase cryptocurrency with the cryptocurrency wallet, third use the cryptocurrency wallet to pay for an NFT on an NFT marketplace and finally, there is the fourth, after sales service that may involve returns, or some other form of support.

The model that is supported by our analysis identified four stages to trust: First trust in the cryptocurrency wallet, second trust in the cryptocurrency purchase, third trust in the NFT marketplace, and fourth trust in after-sales services and resolving disputes.

Reference:

Zarifis, A. & Castro, L.A. (2022) ‘The NFT purchasing process and the challenges to trust at each stage’, Sustainability, vol.14, no.24:16482, pp.1-13. https://doi.org/10.3390/su142416482 (open access)